- July 2, 2024

- Posted by: Code

- Category: Credit Cards

Our experience with the Sam’s Club Synchrony credit card has been nothing short of frustrating and filled with unexpected challenges. It all started on a high note—we were gifted a Sam’s Club membership, a gesture we deeply appreciated. With the new membership, we received an enticing offer for a cashback credit card, promising lucrative rewards when used at Sam’s Club and other locations. However, our journey with this card soon revealed several deceptive aspects that left us feeling scammed.

Misleading Cashback Rewards

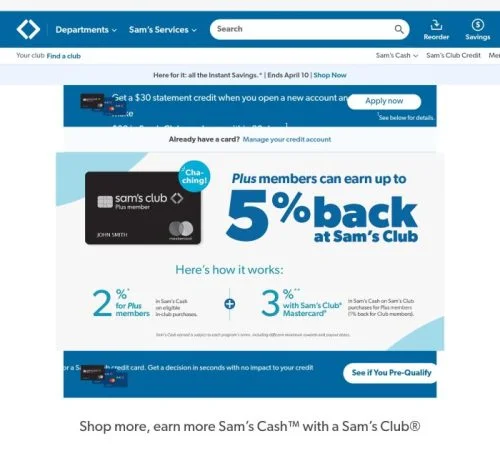

The first red flag emerged when we discovered the stark reality behind the advertised cashback rewards. The promotional material boasted up to 5% cashback on purchases, which sounded like an excellent deal. However, as regular members, we quickly realized that the actual cashback percentage was a meager 1% on in-store purchases. This is a far cry from the advertised 5%, which is only available to Plus members. Although our membership included a Plus level, it was as add-ons, relegating us to basic membership benefits. This misleading marketing tactic left us feeling shortchanged and misled.

The Illusion of Valuable Cashback

While the card does offer 5% cashback on gas purchases, this benefit comes with its own set of limitations. The cashback is not in the form of straightforward cash—it’s Sam’s Cash. This so-called “cashback” is not as valuable as it sounds because it can only be used in restricted ways, such as renewing your membership or making purchases at Sam’s Club. Unlike traditional cashback rewards that can be spent freely, Sam’s Cash lacks fungibility, significantly reducing its worth and versatility.

Autopay Nightmare

The most egregious issue we encountered was with the autopay feature. As someone who routinely sets up autopay to “pay in full,” I distinctly remember selecting this option for my new Sam’s Club card. Imagine my shock when I received a bill with a nearly 50% APR charge on a balance I believed was fully paid off. This unexpected charge felt incredibly scammy and raised serious concerns about the reliability of their billing system. Are they banking on the assumption that customers won’t scrutinize their statements closely?

A Word of Caution

Our experience with the Sam’s Club Synchrony credit card has been an eye-opener. The allure of cashback rewards is overshadowed by deceptive marketing, restricted reward usage, and potentially shady billing practices. If you are considering this card, we urge you to read the fine print, carefully monitor your statements, and be aware of the limitations and potential pitfalls.

In conclusion, while the idea of earning cashback on everyday purchases is appealing, the Sam’s Club Synchrony credit card falls short of delivering genuine value. The misleading cashback percentages, restricted reward usage, and issues with autopay setup combine to create a less-than-satisfactory experience. We hope our cautionary tale helps others avoid the frustrations we faced and make more informed decisions about their credit card choices.