- April 21, 2021

- Posted by: ad-in

- Categories: ecommerce, Economics, Funding trends

Are you interested in getting started investing in cryptocurrencies like Bitcoin or Ethereum? Don’t listen to Paul Krugman!

“Bitcoin looks like it really is a bubble in multiple senses,” Paul Krugman famously said in 2015, when it was trading for roughly $300. “Certainly, [there’s] not a reason to hold that currency.” Bitcoin is now worth over $50k per. Suffice it to say that if you put $10,000 into a portfolio dedicated to the opposite of everything Paul Krugman liked over the years, you would be the richest person in the world.

And now, with the Federal Reserve printers running at full output, Bitcoin and other cryptocurrencies are looking even better as a way to preserve wealth. It’s been a longer road than we predicted in 2014, but one of the hottest markets in the world right now is cryptocurrencies. Cryptocurrencies (or crypto) may seem like absolute Greek to most people but they are the future and they are important to understand and invest in before they are mainstream in order to capitalize fully on the industry.

We’d like to provide an easy way of getting started in cryptocurrencies and start making money!

Crypto Primer

Cryptocurrencies are currencies that are differentiated from government fiat currencies like the US dollar or British Pound and other media of exchange like gold in that they are based solely on computer algorithms. Whereas you can give someone a physical dollar bill in exchange for goods or services, you need an app to transfer cryptocurrencies from one person to another. For most cryptocurrencies, a complex network of computers track transfers between parties on what is called the block chain. This digital history solved the problem of digital duplication in a clever, but cumbersome way. The result is a secure but expensive way to guarantee wealth transactions.

The benefits are great though, as SatoshiLabs explains:

Bitcoin was designed to transfer money peer-to-peer without the need for a bank. Not only does it restore all the advantages of cash, it transposes them to a decentralized, digital environment where transactions are completely borderless. There is no way to stop someone from having Bitcoin, and it can be accessed from anywhere in the world. It is also impossible to counterfeit, a problem which cash has never overcome.

In many cases, cryptocurrencies like Bitcoin have other benefits like a limited supply, making them a great hedge against inflation.

Down the Rabbit Hole

As a friend said recently, cryptocurrencies appear to be at the “AOL CD-ROM” stage of the Internet right now, which could mean that the growth potential is astronomical from where we are. Crypto is definitely here to stay and it appears that there are endless directions the industry can go from basic financial tools to common money to completely detached economies.

The rabbit hole is definitely a thing and can be intimidating. But it is very easy already to get started and make money in crypto. We will outline a few of the easiest and most profitable ways.

Getting Started In Cryptocurrencies: Centralized Exchanges

The easiest and most user-friendly way to invest in crypto is centralized exchanges.

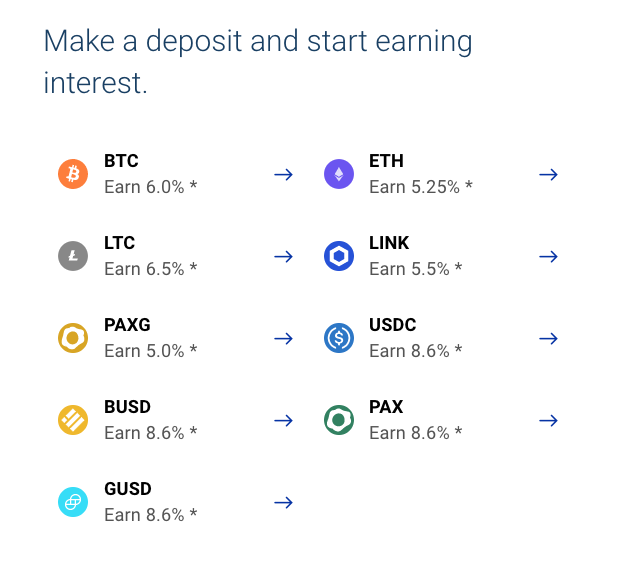

BlockFi is a cryptocurrency bank that provides interest-earning deposit accounts and low-cost USD loans. You can buy crypto with US dollars through ACH (in many but not all states). At the time of writing, you could earn 8.6% APY on stablecoins (cryptocurrencies that are tied to the US dollar) and up to 6.5% APY on alt coins:

You can get $30 in Bitcoin (BTC) when you sign up through this link: https://blockfi.com/?ref=23ac5155

Uphold is possibly the most flexible and diverse investment platform. Its crypto offerings aren’t very big but they’re growing and you can also trade fiat and precious metals, which is great. They also are working with Brave wallet to integrate your BAT with the rest of the crypto world. Get $20 in BTC when you sign up, get verified, and invest more than $250 through this link: https://uphold.com/signup?referral=1c62553105

Coinbase is probably the biggest exchange and offers a wide range of services including trading currencies, educational videos, and staking (investing). Their rates aren’t nearly as good or as plentiful as BlockFi, but more people can access the platform.

DISCLAIMER: Coinbase says that they don’t take a fee for conversion but each transaction mysteriously loses value. This is how they explain it: “When you convert one cryptocurrency to another, the amount you receive will be less than the amount you converted. This is caused by the ‘spread’ between the buy and sell prices quoted for each cryptocurrency. Your conversion will execute at a price within 2% of this quoted price or the transaction may be canceled.” Thanks for the heads up!

You can earn $10 in Bitcoin by funding your account through this link: https://www.coinbase.com/join/nhk4

Cryptocurrency Wallets

Both BlockFi and CoinBase allow you to send and receive crypto in a wallet, which is what it sounds like. In order to hold crypto, you need a wallet. Wallets can be cold (a physical thumb drive that is not connected to the Internet) and hot (connected to the Internet). Ledger is a popular cold wallet and MetaMask is a popular mobile-based wallet.

The important thing to understand about wallets is that to maintain a high degree of security crypto wallets are backed up with seeds (a series of words) that it’s recommended that you store on a physical item (paper) in a secure place. If your phone is stolen, for instance, you will be able to recover the funds on your wallet with your seed words only. If you lose your seed words, you lose your funds.

Crypto 201: Decentralized Exchanges

Once you have your own crypto wallets secured with the seed phrase safely backed up in multiple places, you can look into decentralized exchanges, which offer the best way to maximize your investment. Decentralized finance (DeFi) is a realm of platforms and protocols in which people can store their crypto currencies and many times earn interest and rewards on their holdings.

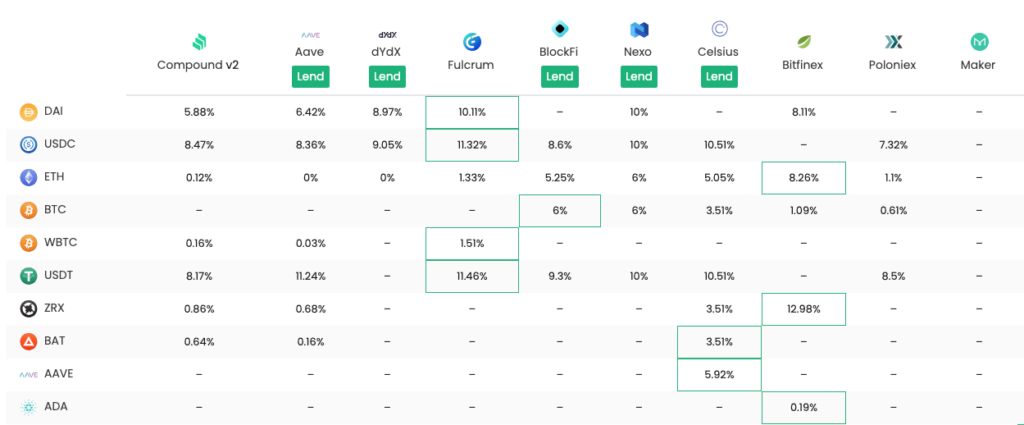

DeFiRate.com lists the main DeFi sites and their rates for various cryptocurrencies in a concise format here:

DeFiRate highlights the highest rate currently for each currency and the best rate over the last 30 days. As you can see in the screenshot, Flucrum has very high rates, especially for stablecoins. They also have a complex fee structure that may intimidate some investors.

Fulcrum provides a platform for lending and borrowing and is back by an insurance fund. Since it is genuinely defi, there are no fees but 10% goes to the insurance. You can also trade with up to 15% leverage.

Aave provides a very interesting decentralized platform with transparent, market-driven interest rates. When the demand is high for a particular cryptocurrency, the rates for deposits and borrowing go up in a straightforward manner. You can borrow at a variable or static rate and you can earn interest at a variable rate based on demand. The fees can be very high for the transactions because the contracts produced for them are much more complex. A transaction fee of over $100 isn’t uncommon since these fees are based on network congestion, so this really only makes sense for large investments.

You can connect your wallet to either of these platforms to use the coin right from your wallet.

Now that you have a grasp of crypto basics, you should feel comfortable sending us a crypto tip through our site or straight to our ERC-20 wallet (for any Ethereum-based coin): 0x956F4CbFb1C20Da160C369c15c0560F666e9f432

All Too Much?

If all that is too much to wrap your head around and you just want to ride the wave of cryptocurrencies (to the moon or other place), Robin Hood may be an easy way to invest. While you don’t actually hold the currency on Robin Hood, you can invest and reap the benefits of increasing prices. Trades are free and if you sign up through the below link, they’ll even give you a free stock:

join.robinhood.com/josephm-0dd191