- March 2, 2021

- Posted by: ad-in

- Categories: ecommerce, Economics

If you’re going to pay the same price for something regardless of whether you use cash or a credit card, you might as well use the credit card and get paid for doing it. This little reward for using a card adds up to thousands of dollars a year when you spend the average amount. Depending on how you work it, you can get over 5% of your expenditures back. This isn’t chump change!

Many people use other types of reward cards—most notably airline miles cards—but we’ve determined that the best reward is cash because it’s straightforward and not easily manipulated. Also, using your rewards cards for gift cards doesn’t make sense because it limits what you can spend the money on and if you use a gift card on a purchase you would have otherwise used a credit card on, you lose that additional cashback reward. Use the card again and pay for it with the rewards cash and you earned another cashback reward.

Here are the best cashback cards out there and their benefits.

Discover It

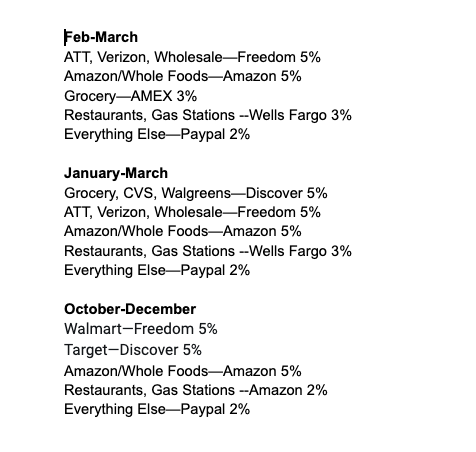

Discover pioneered this with its Discover It card that offers 5% cash back on certain categories each quarter and 1% on everything else. They make you keep track of where you’re using which card but a simple monthly list helps keep that straight. There’s a $75 limit on rewards for the categories, so you need to keep track of that. Once you’ve maxed out on the bonus reward, it probably makes sense to shift your purchases to another card.

Amazon Prime

If you have Amazon Prime, this Visa is essential to maximizing your Amazon and Whole Foods value. Using the Prime card at both locations gets you 5% cashback without limit. You also get 2% on restaurants and gas stations and 1% on everything else.

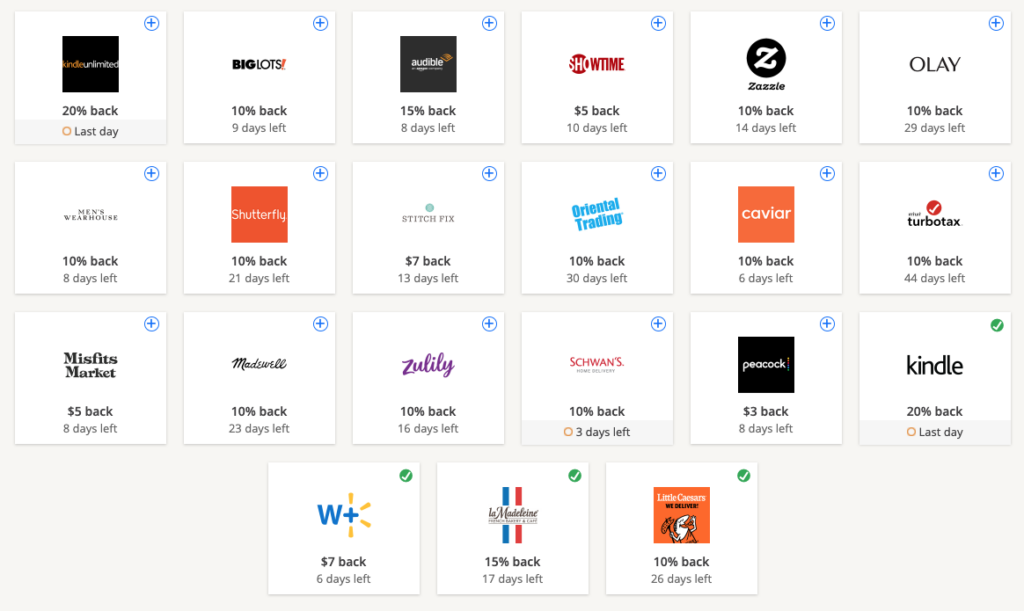

Included with the Amazon Prime Card is Chase Offers, which is a fun way to get an additional 10-15% off various vendors including our favorites: restaurants. You have to activate each individual deal on the Chase website and they have various expirations, but it gives you bonus savings on stuff you buy already or may give you incentive to try something new.

Chase Freedom

Chase Freedom is structured much like the Discover card with 5% cashback on quarterly categories ($75 limit) and 1% on everything else. These categories change so you need to change the card list every quarter, but they make it worthwhile.

Freedom also has the Chase Offers, which gives you an additional 10-15% as described above.

Wells Fargo PROPEL AMEX

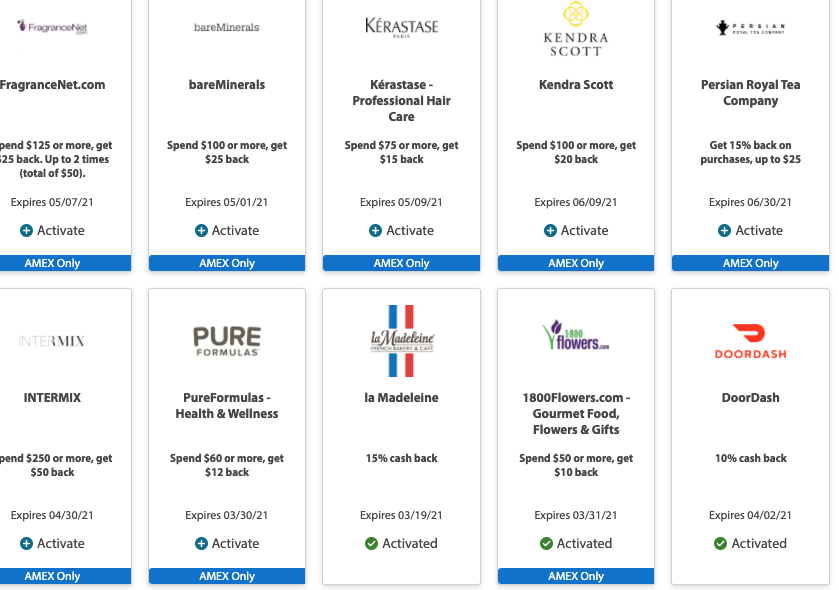

The Wells Fargo PROPEL Amex is a new rewards cards focused on travel and entertainment spending. You can get 3% cashback on hotels, flights, restaurants, rideshare, and gas stations with 1% on everything else. The card also has special Wells Fargo Deals with an extra 10-15% off:

AMEX Blue Cash

We use the Amex Blue Cash Everyday for non-Whole Foods groceries, which gets us a cool 3%, gas stations (2%), and several department stores (2% at Bealls, Belk, Bloomingdale’s, Bon Ton Stores, Boscov’s, Century 21 Department Stores, Dillard’s, J.C. Penney (JCP), Kohl’s, Lord & Taylor, Macy’s, Neiman Marcus, Nordstrom, Saks Fifth Avenue, Sears and Stein Mart).

PayPal Cashback

The PayPal Cashback Mastercard is a great everything else card because you can get 2% cashback on everything. They don’t go higher for any other categories, but every once in a while they will make it 3 or 4% cashback on everything for a limited time, which we jump on.

BlockFi Bitcoin Rewards

If you’re interested in cryptocurrency, there are a few options for cashback or “coinback” cards. I recently got started with the BlockFi Bitcoin rewards card, which is offering 3.5% cash back converted into Bitcoin for the first 90 days of the account (it comes down to 1.5% Bitcoin back after the first 3 months). The beauty of this is that you can obtain free coin for free. Typically, you would incur a fee to convert US dollars into cryptocurrency but this is all free.

Sign up for BlockFi here: https://blockfi.com/?ref=23ac5155

Nexo Card

The Nexo card advertises 2% cashback on every purchase and it’s run through the Mastercard network. It’s not clear if this is a rewards debit card or a true credit card on the balance of your crypto.

Sign up for Nexo here: https://nexo.io/nexo-card?referral=W0GyvDD&refSource=copy