- August 3, 2022

- Posted by: Code

- Category: Credit Cards

I got a balance transfer offer from Capital One last year for my Quicksilver credit card and I like to take advantage of these offers to make money. The deal was, I would pay 3% flat fee, then 0% interest for a year. Usually, I make sure to track when I need to pay off the card to avoid the interest rate spike and crazy interest charges. But I didn’t do that for this one for some reason and, of course, they don’t display the end of the rate online because they no doubt want you to pay interest.

So, I called and a customer service representative stated that I had several months more for the promotional rate.

“Great!” I thought and didn’t pay off the card.

A couple days later, I got $114 interest charge for the money that was supposedly under the promotional rate.

I called to get some clarification and they bumped me up to an account supervisor who, after expressing some skepticism that I incurred the debt through a promotional offer at all, was able to figure out the truth: the rate had ended.

I asked her if she could waive the interest rate considering a Capital One customer service representative had misinformed me that the rate was still good through October and she said she couldn’t. Yeah right.

If you have an option, please don’t do business with these people. You may save yourself the infuriating experiences like this.

Maybe I should take them to small claims court….

UPDATE:

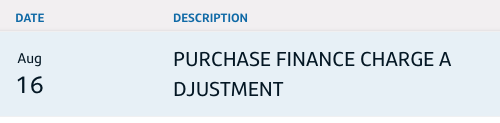

After posting this and several complaints on consumer reporting sites as well as explaining the issue in a Capital One customer service survey, they reversed the interest charge. I didn’t receive any message or fanfare, just saw the credit in my account:

So, they redeemed themselves though I’m not sure it should have taken my response to prompt it!